When we work with and talk to people on the fence about buying versus renting, we like to bring up a couple of worthwhile considerations you might otherwise miss:

- Opportunity costs of home ownership vs renting and “upfront costs”

- Write-off value of mortgage interest

- What you get for a similar monthly expense in a buy vs. rent situation locally

- Economic trends that will likely affect the area’s home values over time

- Neighborhood specific differences

What can you get when you rent or buy in Moorestown?

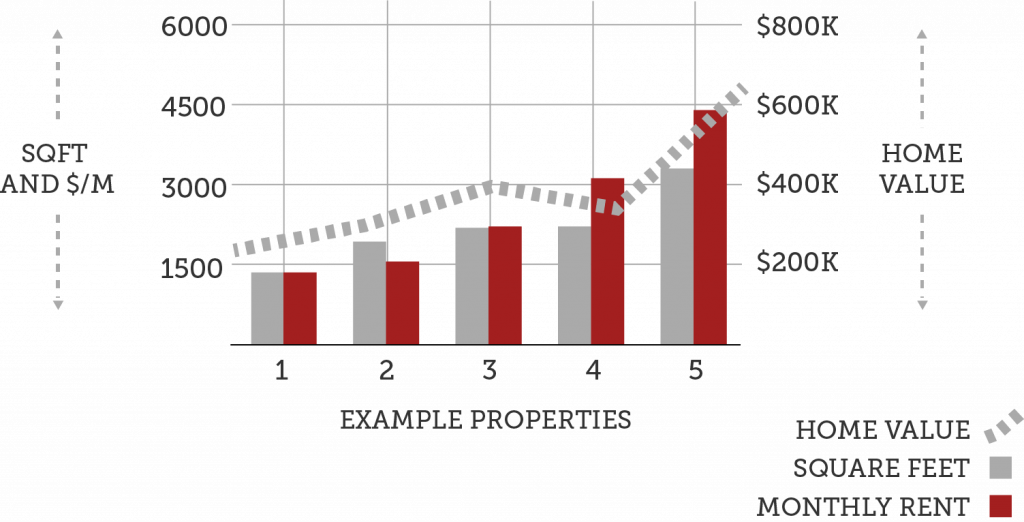

We took a sampling of real properties in Moorestown that have recently been rented at the following prices, and then ran a home valuation report on each one, looking at only the most comparable recently sold homes. Here’s what we found:

- A well maintained 3,400 square foot property backing up to Laurel Creek Country Club area worth $650,000 (based on similar properties recently sold) rented for $4,500/month

- A newer and partially updated 2,300 square foot property backing up to Laurel Creek Country Club area worth $340,000 (based on similar properties recently sold) rented for $3,200/month

- A Victorian style property on a much smaller lot with 2,300 square feet 2 blocks from the heart of town, Moorestown Main Street, worth $400,000 (based on similar properties recently sold) rented for $2,300/month.

- A single family home near Schoolhouse Mews area, valued at $300,000 with almost 2,000 square feet rented for approximately $1,600/month.

- A West Moorestown row, closer to Lenola area, valued at $230,000 with 1,400 square feet rented for approximately $1,400/month.

Let’s look at a scenario using the middle of the road example:

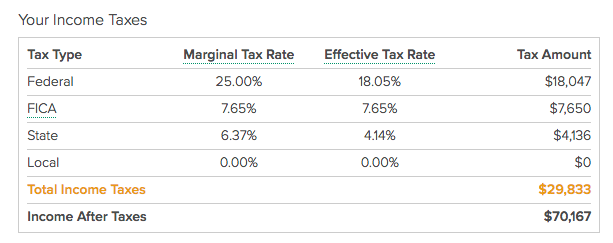

John Black is an employee. He makes $100,000 per year and has almost no expenses he can deduct when doing his taxes. As a Moorestown resident, his federal, state, and local income taxes add up to approximately $35,000 with a Burlington County tax rate of 5.53%).

(Source: Federal, State & FICA calculated via smartasset)

As a homeowner, if John’s mortgage is $350,000, then he’ll pay about $1,770 monthly (at a 4.5% interest rate) or $21,240 per year.

But what if he’s renting?

Well, if John wants to rent a similarly valued home in Moorestown, he’s going to pay approximately $2,300 per month or $27,600), or about $6,300 more.

What John also might not realize is that if he were to purchase a home, he could write off the interest on his mortgage. He’s been getting hammered on income taxes because he has no deductions as an employee. Buying a home, he could benefit from a $15,600 tax write-off in his first year. At his approx. 35% tax rate, that’d be about a $5,000 tax write off.

So we just found John $11,300.

If John opts for a FHA loan, he’s going to have to put 3.5% down when buying a $360,000 home (the average sale price in the area he’s looking), which is $12,600 (not including closing costs).

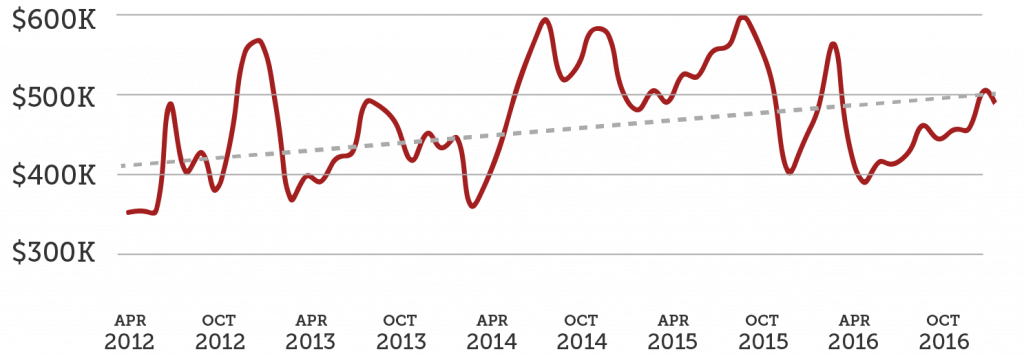

In Moorestown, property values increased by 4.3% last year. If that trend continues, in his first year, he’ll earn an additional $15,500 in equity on top of the $5,600 in principal he pays down on his mortgage (principal / interest ratios calculated via creditkarma amortization schedule).

Between his tax write-off, what he saved paying a mortgage instead of rent, the estimated home value increase over his first year, and payments toward principal that otherwise would have disappeared going towards rent, John is doing about $32,400 better than he would have if he rented:

$5,000 + $6,300 + $5,600 + $15,500 = $32,400 Saved

What about closing costs you might ask?

His Realtor was a master negotiator and worked creatively with the listing agent to get John a 2% seller assist, well within the range allowed by FHA, and it covered his closing costs.

The Opportunity Costs of Owning a Home

Whenever I talk to a financial advisor, I get the same feedback – Americans should be diversifying their investments, not tying it all up in a house. But here’s the problem with that attitude: for one, it assumes Americans are going to buy as much house as they qualify for rather than living within their means, and secondly, half of Americans save almost nothingaccording to a survey by Bankrate. Only about 25% of people are saving more than 10% of their earnings.

In addition, the US Government Accountability Office (GAO) claims nearly half of households with 55+ aged Americans do not have retirement accounts (like 401ks and IRAs). So for many American homeowners, adding equity through mortgage payments is their primary source of savings, whether it’s to help pay their kids college tuition or having a nest egg on which to retire. Financial advisors can talk all day about what Americans shoulddo, but the reality is that Americans with homes save through making their mortgage payments, and many of those without homes don’t save at all.

So Should You Rent or Buy?

The reasons people rent are the same reasons they should buy now. Renting may seem like the conservative move while you save for a down payment, but as we’ve shown above, in Moorestown, every month you rent is a month you didn’t add savings through equity or save money on the monthly cost to rent being 15-25% higher than the cost of a monthly mortgage payment.

For more information, you should consult with your CPA or tax advisor.

More Resources

Taxable Income Table for New Jersey

- 1.4% on the first $20,000 of taxable income.

- 1.75% on taxable income between $20,001 and $35,000.

- 3.5% on taxable income between $35,001 and $40,000.

- 5.525% on taxable income between $40,001 and $75,000.

- 6.37% on taxable income between $75,001 and $500,000.

Burlington County Income Tax Rate : 5.53%