Taxes

Haddonfield is located in Camden County, while Moorestown is part of Burlington County. Generally speaking, Haddonfield residents pay more in taxes than Moorestown residents, as the tax rate for Haddonfield is higher.

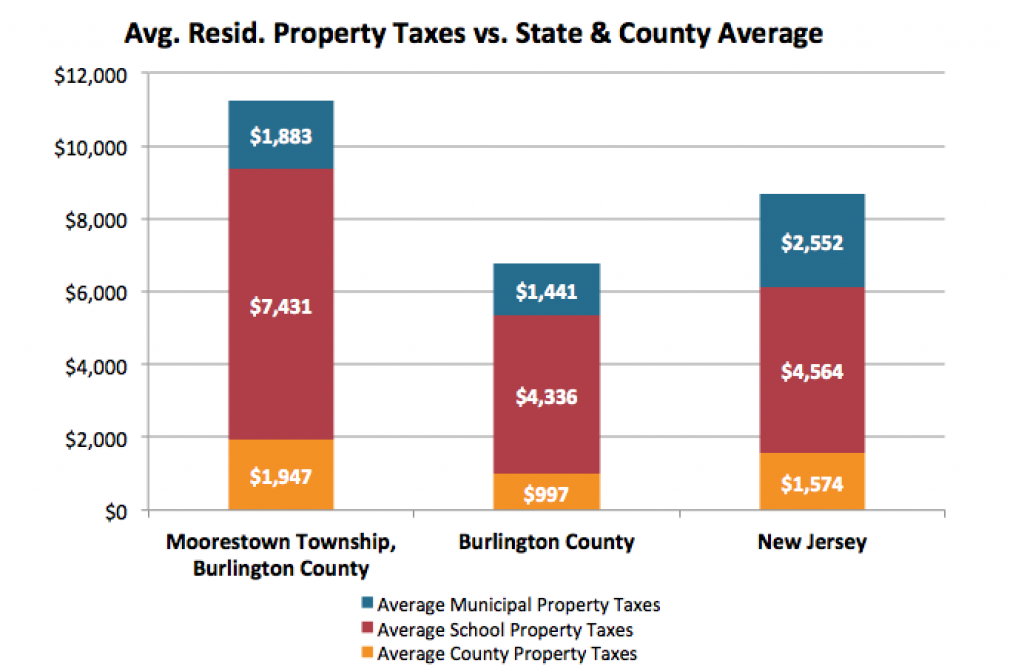

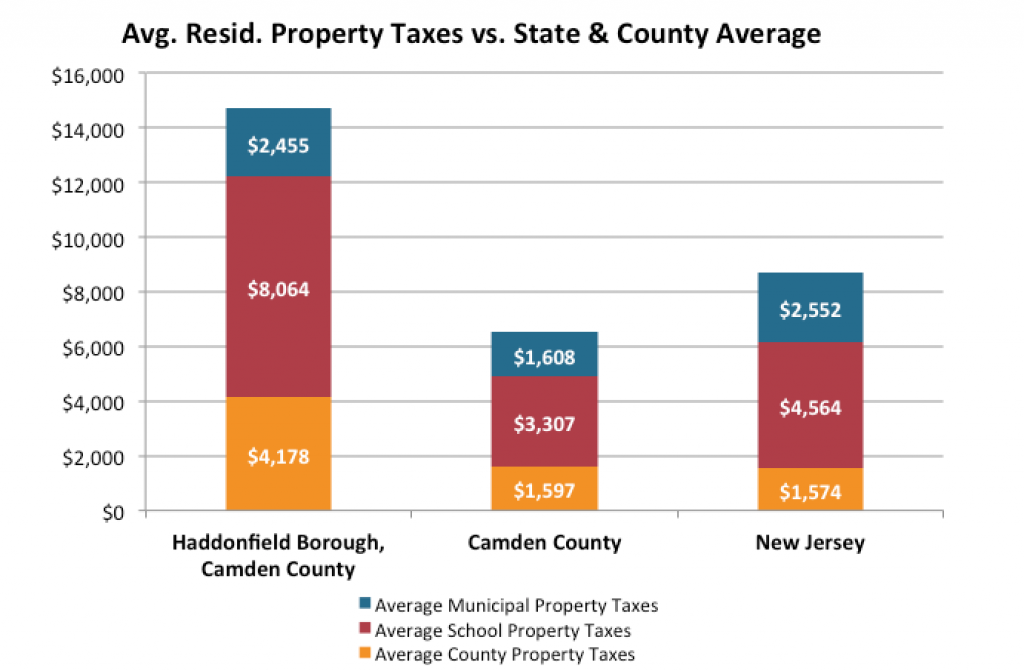

Moorestown total property tax rate is 2.187 for 2017, with an average total property tax of $11,261. Haddonfield total property tax rate is 2.935 for 2017, with an average total property tax of $14,697.

| Haddonfield | Moorestown | |

|---|---|---|

| Property Tax Rates | ||

| County Property Tax Rate | 0.834 | 0.378 |

| School Property Tax Rate | 1.610 | 1.443 |

| Municipal Property Tax Rate | 0.490 | 0.366 |

| Total Property Tax Rate | 2.935 | 2.187 |

| Average Residential Property Taxes | ||

| Avg. Residential Property Value | $491,674 | $449,016 |

| Avg. County Property Taxes | $4,178 | $1,947 |

| Avg. School Property Taxes | $8,064 | $7,431 |

| Avg. Municipal Property Taxes | $2,455 | $1,883 |

| Avg. Total Property Taxes | $14,697 | $11,261 |

Average Moorestown Property Taxes Compared to Burlington County and New Jersey

Average Haddonfield Property Taxes Compared to Camden County and New Jersey

Source: 2017 http://nj.gov/dca/divisions/dlgs/resources/property_tax.html